Megan McArdle points out some reasons to buy a home--such as avoiding costs to moving and having the freedom to customize your space--but she forget a key issue: avoiding horrible landlords. While buying a house comes with the risk of getting a lemon, landlords can be the same way. They can be behind on repairs, rude, or lax on the law (which can cause many problems for you later). In one place I lived, a surprise investigation revealed that one of the rooms was not legally occupied since it lacked the proper amount of window space. A huge headache followed, eventually resulting in the occupant leaving the house.

There's something to be said for removing another person from the upkeep equation. While you lose the chance of professional specialization, you also remove the possibility of negligence which often accompanies a new (or even experienced) landlord. Many of these problems go away when you own your own home (sure, the plumbing still needs fixed, but now you're depending on the plumber instead of depending on the landlord who's depending on the plumber).

Tuesday, December 29, 2009

Sunday, December 27, 2009

Santa the Slaver

In countless Christmas movies, we get the impression that the elves of Santa's workshop are happy, joyful people who do all their work for fun. It's part of the myth: who would want toys from a man who forces elfin creatures to do his bidding only to then give away all of their hard work to strangers and force them to start all over? The more you think about Santa, the more I realize those elves are his slaves.

(1) Santa has no income. Maybe all those fake Santas which crowd the malls bump up part of their paycheck to the big man (think of it like a franchise), but that wouldn't be enough to cover the cost of materials, let alone labor.

(2) There's no way that the North Pole is the elves' natural habitat. They don't have the fur needed comfortable survive there. Typically elves live in the forest. Now, obviously, Santa wants to be isolated from the humans which is why he lives in the North Pole. But there are plenty of other places he could be, places more hospitable for his elves (here's a map of the world based on how long it takes to get to a major city). The Amazon is quite isolated, as is the Sahara Desert. The Himalayas are warmer than the North Pole if you don't go too high. All are viable candidates. But Santa picked one of the most inhospitable places on the planet for one reason: to keep the elves indoors. If he was in the Amazon, in a place they were comfortable in, they might run outside instead of working. Not only did Santa kidnap them, he's trapped them in a work camp.

(3) But if they like to work, then it's ok, right? Well, if they like to work, why do they need Santa? Why not just stay in their natural habitat and send toys out into the world? Hauling cargo is work, too. Yes, they won't have Santa's magical powers to deliver them all on Christmas Eve, but so what? Unless you're talking about something that could spoil or die (which accounts for a tiny fraction of presents), they can be delivered weeks or even months in advance. It's more likely that after Santa kidnapped them, he lied, claiming the presents had to come out on the 24th and only the 24th, thus "justifying" the kidnapping.

(4) But what about all the shots from movies and television with the happy elves? For one, that's fantasy and you're mistaking what's fake for what's real. (Grow up, seriously.) Besides, Santa's an all powerful being (which brings up the question of why he doesn't make the toys himself): he brain-washes them.

(1) Santa has no income. Maybe all those fake Santas which crowd the malls bump up part of their paycheck to the big man (think of it like a franchise), but that wouldn't be enough to cover the cost of materials, let alone labor.

(2) There's no way that the North Pole is the elves' natural habitat. They don't have the fur needed comfortable survive there. Typically elves live in the forest. Now, obviously, Santa wants to be isolated from the humans which is why he lives in the North Pole. But there are plenty of other places he could be, places more hospitable for his elves (here's a map of the world based on how long it takes to get to a major city). The Amazon is quite isolated, as is the Sahara Desert. The Himalayas are warmer than the North Pole if you don't go too high. All are viable candidates. But Santa picked one of the most inhospitable places on the planet for one reason: to keep the elves indoors. If he was in the Amazon, in a place they were comfortable in, they might run outside instead of working. Not only did Santa kidnap them, he's trapped them in a work camp.

(3) But if they like to work, then it's ok, right? Well, if they like to work, why do they need Santa? Why not just stay in their natural habitat and send toys out into the world? Hauling cargo is work, too. Yes, they won't have Santa's magical powers to deliver them all on Christmas Eve, but so what? Unless you're talking about something that could spoil or die (which accounts for a tiny fraction of presents), they can be delivered weeks or even months in advance. It's more likely that after Santa kidnapped them, he lied, claiming the presents had to come out on the 24th and only the 24th, thus "justifying" the kidnapping.

(4) But what about all the shots from movies and television with the happy elves? For one, that's fantasy and you're mistaking what's fake for what's real. (Grow up, seriously.) Besides, Santa's an all powerful being (which brings up the question of why he doesn't make the toys himself): he brain-washes them.

Labels:

Entertainment

An Item From Santa's Lap

Paul Krugman applauds the Senate health care bill for, among other things, forcing insurance companies to cover patients with pre-existing conditions. This has been a long standing point of reform: why should a family be forced to cover the expenses of a medical problem when they had no role to play in the development of the condition. It's not as if they're smokers suffering from lung cancer. And many families can't afford the very expensive treatments that come with such conditions. But insurance companies can and so, the argument goes, they should pay.

For one, I'm not sure they can, but there's a deeper point. A pre-existing condition is tragic, doubly so if burdened on a family who cannot afford to properly address the issue. But that does not translate into forcing someone else to shoulder the burden, whether the target is insurance companies, hospitals, or the U.S. government (though the last is most justified since, in theory, it works for all of us). Some believe that doesn't matter; covering such individuals is the right thing to do. But that misses the larger picture. Even if they could afford it and even if they could continue to afford it for the foreseeable future, it would be ethically wrong to force one group to shoulder the problems of another group. Yes, I know we do this a lot already, but that's hardly grounds to keep doing it.

Here's an analogy. Some people are born ugly, or stupid, or socially awkward. Such people have difficulty getting dates or maintaining friendship. While befriending a person with such a pre-existing condition just to be nice would be seen as an admirable act of kindness, no one would agree to a policy which forces people to befriend or date such individuals. It would be seen as unethical, even if the individual is not able to "afford" such loneliness (i.e. they are suicidal).

It's all well an good to ask for things but you have to think about where they come from.

For one, I'm not sure they can, but there's a deeper point. A pre-existing condition is tragic, doubly so if burdened on a family who cannot afford to properly address the issue. But that does not translate into forcing someone else to shoulder the burden, whether the target is insurance companies, hospitals, or the U.S. government (though the last is most justified since, in theory, it works for all of us). Some believe that doesn't matter; covering such individuals is the right thing to do. But that misses the larger picture. Even if they could afford it and even if they could continue to afford it for the foreseeable future, it would be ethically wrong to force one group to shoulder the problems of another group. Yes, I know we do this a lot already, but that's hardly grounds to keep doing it.

Here's an analogy. Some people are born ugly, or stupid, or socially awkward. Such people have difficulty getting dates or maintaining friendship. While befriending a person with such a pre-existing condition just to be nice would be seen as an admirable act of kindness, no one would agree to a policy which forces people to befriend or date such individuals. It would be seen as unethical, even if the individual is not able to "afford" such loneliness (i.e. they are suicidal).

It's all well an good to ask for things but you have to think about where they come from.

Labels:

Ethics

Monday, December 14, 2009

Patent Number 5,547,091

When I shop for toothpaste, I prefer the caps with the flip top so I don't have to remove the cap when I brush my teeth. I usually forget to look since I tend to forgot to buy it in the first place but today I remembered. In my search for the flip-top cap, I discovered only one brand, Colgate, has them. Moments after I thought that was strange, I suspected the answer. A search at the PTO website confirmed my suspicions. It's patent number is 5,547,091. Here's the abstract:

A closure for a container having a dispensing nozzle include a central aperture to receive the nozzle. In one embodiment, the nozzle extends through the aperture and projects upwardly from the base cap. The base cap further includes a top wall inclined with respect to the central axis of the base cap to assist in dispensing of the contents of the container. A cap lid is hinged to the base cap by a snap hinge assembly.The patent was issued on August 20, 1996. Thus, on 2016, the "who didn't replace the cap on the toothpaste" arguments will evolve into "who didn't shut the toothpaste" arguments. And we'll all be happier for it.

Labels:

Technology

Sunday, December 13, 2009

Darwin Zero

I found this post via Megan McArdle concerning the data surrounding climate change in the wake of "climategate." It's an interesting post but it's long. It's a case study on a temperature record station, Darwin Zero, and how climatologists adjust the raw data to something that is consistent across the past century. There's good reason to have adjustments (changes in station location, instruments, time of temperature recording, etc) but the adjustments to Darwin Zero are very...strange.

From the author:

This doesn't mean that all adjustments are suspect or that climatologists are lying or even that these are falsifications (though you can bet I'd like to know the reasoning behind those adjustments). And over the years, I've become more sympathetic of climatologists' claims (decentralized researchers all saying about the same thing is a good litmus test for truth). But it does highlight the need for publicly available raw data and comprehensive explanations for all the adjustments. If the scientists really want to convince people, transparency is key.

From the author:

Yikes again, double yikes! What on earth justifies that adjustment? How can they do that? We have five different records covering Darwin from 1941 on. They all agree almost exactly. Why adjust them at all? They’ve just added a huge artificial totally imaginary trend to the last half of the raw data! Now it looks like the IPCC diagram in Figure 1, all right … but a six degree per century trend? And in the shape of a regular stepped pyramid climbing to heaven? What’s up with that?

This doesn't mean that all adjustments are suspect or that climatologists are lying or even that these are falsifications (though you can bet I'd like to know the reasoning behind those adjustments). And over the years, I've become more sympathetic of climatologists' claims (decentralized researchers all saying about the same thing is a good litmus test for truth). But it does highlight the need for publicly available raw data and comprehensive explanations for all the adjustments. If the scientists really want to convince people, transparency is key.

Labels:

Global Warming

Monday, December 07, 2009

Ten Red Balloons

DARPA's awarding $40,000 to the first person or team to find ten red balloons which were spread all over the country on December 5th. The goal is to learn how people organized in large teams use computers to socially network. What software will we see? Will there be spying? Attempts to misinform other teams? I'm not clear how they will measure all they want to measure, but the prospects look very interesting.

December 5th was the 40th anniversary of Arpanet, the Internet's precursor.

HT: Alex Tabarrok

Update: Here are the results.

December 5th was the 40th anniversary of Arpanet, the Internet's precursor.

HT: Alex Tabarrok

Update: Here are the results.

Labels:

Prizes

Sunday, November 29, 2009

The Paradox of Happiness

Disciplines are always most interesting when they cross with other disciplines and the economics of happiness is no exception. Talking to some of my friends the other day (one versed in anthropology and another in psychology), we noted how much people value a sense of genuine accomplishment and is probably why, in some cases, wealthy people aren't as happy as less wealthy people. (Setting aside the lower mortality rates in poorer societies.)

For example, the people of the indigenous tribe that must work every day to get a meal are going to be happier (assuming they are successful) than the middle management who, while isn't concerned about getting his next meal, has no sense of accomplishment and feels as though his life is wasted. (This, by the way, is how many mid-life crises take root.) Indeed, people who have the option to leave their tribe in favor of modern life tend not to take it (I know this is very common among the Amish, and I'm sure a similar story can be told for other groups).

However, I argue that the wealthier, accomplished person will be happier than the less wealthy accomplished person ("accomplished" being defined as the standard of the society...for example, getting a book published in the wealthier society versus bringing home a kill in the less wealthy one). Some expressed doubt to the claim, so here's my reasoning.

First definitions: p (probability of achieving an accomplishment); S (happiness from achieving survival); s (happiness from surviving); A (happiness from achieving something else); and a (happiness from that something else). This draws the distinction, for example, between the sense of achievement from a book published and the royalties received from getting a book published. Note I'm also assuming it's equally likely to achieve something in a rich society and in a poorer society. This is primarily to make the math easier.

A person would be indifferent between two societies if:

p(S+s) = p(A+a)+s,

where the right-handed side is the wealthier society (they get the benefits of survival without trying) and the left-handed side is the indigenous society. Simplifying reveals:

S-A = a+((1-p)/p)s

In other words, there must be a larger sense of accomplishment from surviving than from other accomplishments to make a person indifferent. To make a person prefer the less wealthy societies (which I strongly doubt), the premium (S-A) would have to be greater than a+((1-p)/p)s, which I doubt since both values are positive and a might well be quite large.

Now consider the scenario when p=1, or when you are comparing people in each society who have made achievements (either in survival or in something else). The equation becomes:

S-A = a

If we think of such individuals in each society as sharing common traits (intelligence, drive, etc), then this means that more capable people are less likely to prefer modern society compared to less capable people--it all depends on the additional satisfaction derived from achieving survival versus achieving something else. While I imagine this premium to be quite small, the fact that this (simple) model predicts "stronger" people are more likely to prefer an environment that is more dangerous seems to be quite the paradox.

For example, the people of the indigenous tribe that must work every day to get a meal are going to be happier (assuming they are successful) than the middle management who, while isn't concerned about getting his next meal, has no sense of accomplishment and feels as though his life is wasted. (This, by the way, is how many mid-life crises take root.) Indeed, people who have the option to leave their tribe in favor of modern life tend not to take it (I know this is very common among the Amish, and I'm sure a similar story can be told for other groups).

However, I argue that the wealthier, accomplished person will be happier than the less wealthy accomplished person ("accomplished" being defined as the standard of the society...for example, getting a book published in the wealthier society versus bringing home a kill in the less wealthy one). Some expressed doubt to the claim, so here's my reasoning.

First definitions: p (probability of achieving an accomplishment); S (happiness from achieving survival); s (happiness from surviving); A (happiness from achieving something else); and a (happiness from that something else). This draws the distinction, for example, between the sense of achievement from a book published and the royalties received from getting a book published. Note I'm also assuming it's equally likely to achieve something in a rich society and in a poorer society. This is primarily to make the math easier.

A person would be indifferent between two societies if:

where the right-handed side is the wealthier society (they get the benefits of survival without trying) and the left-handed side is the indigenous society. Simplifying reveals:

In other words, there must be a larger sense of accomplishment from surviving than from other accomplishments to make a person indifferent. To make a person prefer the less wealthy societies (which I strongly doubt), the premium (S-A) would have to be greater than a+((1-p)/p)s, which I doubt since both values are positive and a might well be quite large.

Now consider the scenario when p=1, or when you are comparing people in each society who have made achievements (either in survival or in something else). The equation becomes:

If we think of such individuals in each society as sharing common traits (intelligence, drive, etc), then this means that more capable people are less likely to prefer modern society compared to less capable people--it all depends on the additional satisfaction derived from achieving survival versus achieving something else. While I imagine this premium to be quite small, the fact that this (simple) model predicts "stronger" people are more likely to prefer an environment that is more dangerous seems to be quite the paradox.

Labels:

Rationality

Saturday, November 21, 2009

The Value of the Original

The Original of Laura, the last novel of Vladimir Nabokov, was published last week. Normally, a new novel doesn't get a lot of media attention but this one's a little different: Nabokov didn't want it to be published. In fact, he wanted it burned.

It was in his last will and testament that all unfinished works of his should be destroyed. When Nabokov died in 1977, his family didn't carry out this wish. They were emotionally distraught and procrastinated the decision, putting the work in a bank vault. For thirty years, a battle of what The Times called "the demands of the literary world versus the posthumous rights of an author over his art" worn on. Eventually, the literary world won...sort of. The novel, apparently, isn't very good (at least in the state it's in).

According to the author's son, destroying the manuscript was something he never seriously considered. Such an attitude makes me nervous; not only did his son fail to follow an aspect of his last will and testament (as did his wife, who died in 1991), it has the potential to shrink the number of good novels.

Nabokov, like many writers, clearly didn't want works published that fail to live up their standards: even after death (the idea that you leave a part of yourself behind after you die is, I'm sure, a motivation for many writers). Suppose the standard attitude of posthumous publishing becomes "ignore last requests and publish anyway." I guarantee you, some aging authors will be less willing to even start a novel in fear that they won't be able to complete it before their death, even if it turns out they could. This can cost the literary world something very valuable. While suffering from tuberculosis, and certainly concerned he might die soon, Orwell worked on 1984, which was only published a year before his death. Mark Twain, Jane Austen, Charles Dickens, and Jules Verne (to name a few) also published several works near the end of their lives.

It was in his last will and testament that all unfinished works of his should be destroyed. When Nabokov died in 1977, his family didn't carry out this wish. They were emotionally distraught and procrastinated the decision, putting the work in a bank vault. For thirty years, a battle of what The Times called "the demands of the literary world versus the posthumous rights of an author over his art" worn on. Eventually, the literary world won...sort of. The novel, apparently, isn't very good (at least in the state it's in).

According to the author's son, destroying the manuscript was something he never seriously considered. Such an attitude makes me nervous; not only did his son fail to follow an aspect of his last will and testament (as did his wife, who died in 1991), it has the potential to shrink the number of good novels.

Nabokov, like many writers, clearly didn't want works published that fail to live up their standards: even after death (the idea that you leave a part of yourself behind after you die is, I'm sure, a motivation for many writers). Suppose the standard attitude of posthumous publishing becomes "ignore last requests and publish anyway." I guarantee you, some aging authors will be less willing to even start a novel in fear that they won't be able to complete it before their death, even if it turns out they could. This can cost the literary world something very valuable. While suffering from tuberculosis, and certainly concerned he might die soon, Orwell worked on 1984, which was only published a year before his death. Mark Twain, Jane Austen, Charles Dickens, and Jules Verne (to name a few) also published several works near the end of their lives.

Labels:

Private Property

Thursday, November 19, 2009

A Quick Logic Lesson

Earlier today, I published a post exploring the idea of America exiling its prisoners instead of incarcerating them (specifically to Madagascar). I don't seriously endorse the idea but given the burden our prison system is under, I thought it was interesting to explore. However, I decided that it needs to be thought about more carefully so I unpublished it and saved it for a later date.

In the brief time it was up, a commentator wrote (and I'm paraphrasing because I forgot to copy/paste) that Hitler wanted to send Jews to Madagascar (I think we chose the same island) and he/she hoped I wasn't planning something like that. That doesn't work.

The ethical problem with Hitler's plan was not that he wanted to exile a group from a country. It is that he wanted to treat a group of people differently from everyone else on immaterial grounds (ie, religion). Ignoring the nature of the crime for the moment, treating prisoners differently from non-prisoners is not unethical; we do it everyday when we send them to jail. The Hitler analogy is false.

In the brief time it was up, a commentator wrote (and I'm paraphrasing because I forgot to copy/paste) that Hitler wanted to send Jews to Madagascar (I think we chose the same island) and he/she hoped I wasn't planning something like that. That doesn't work.

The ethical problem with Hitler's plan was not that he wanted to exile a group from a country. It is that he wanted to treat a group of people differently from everyone else on immaterial grounds (ie, religion). Ignoring the nature of the crime for the moment, treating prisoners differently from non-prisoners is not unethical; we do it everyday when we send them to jail. The Hitler analogy is false.

Labels:

Logic

Sunday, November 08, 2009

Tea Party History

With the "Tea Party protests" so popular among some Americans as a way to defy big government, a history lesson from one of my favorite books seems appropriate.

Most believe that the original Boston Tea Party was a protest against taxes on tea. In reality, the Americans weren't drinking that much British tea; local merchants have been boycotting it for five years, relying on smuggled Dutch tea instead. So, the British decided to remove some of the taxes on British tea in an attempt to make it competitive with Dutch tea.

Loyal British merchants would be granted the right to sell this cheap tea, effectively running the American merchants out of business. That's what the tea party was all about and why those merchants threw their competition into the ocean. (Granted, this would grant a monopoly on British tea to Loyalists, but the problem with monopolies is they increase price and restrict outputs which wouldn't be an issue here, given it has to compete with Dutch tea.) The famed party wasn't a protest of tariffs, it was a protest for a lack of tariffs, as bootleggers supported Prohibition and drug dealers benefit from the DEA.

The Tea Party wasn't celebrated in the colonies, either. The systematic destruction of private property highlighted Massachusetts' reputation as a place for warmongers and Benjamin Franklin demanded that the protesters pay full restitution to the owners of the destroyed tea.

As much as I empathize with the concerns of the modern protesters, this probably isn't the thing you want to be referencing to get your point across.

Most believe that the original Boston Tea Party was a protest against taxes on tea. In reality, the Americans weren't drinking that much British tea; local merchants have been boycotting it for five years, relying on smuggled Dutch tea instead. So, the British decided to remove some of the taxes on British tea in an attempt to make it competitive with Dutch tea.

Loyal British merchants would be granted the right to sell this cheap tea, effectively running the American merchants out of business. That's what the tea party was all about and why those merchants threw their competition into the ocean. (Granted, this would grant a monopoly on British tea to Loyalists, but the problem with monopolies is they increase price and restrict outputs which wouldn't be an issue here, given it has to compete with Dutch tea.) The famed party wasn't a protest of tariffs, it was a protest for a lack of tariffs, as bootleggers supported Prohibition and drug dealers benefit from the DEA.

The Tea Party wasn't celebrated in the colonies, either. The systematic destruction of private property highlighted Massachusetts' reputation as a place for warmongers and Benjamin Franklin demanded that the protesters pay full restitution to the owners of the destroyed tea.

As much as I empathize with the concerns of the modern protesters, this probably isn't the thing you want to be referencing to get your point across.

Labels:

Taxes

Sunday, October 25, 2009

Singles in DC

DC is apparently packed with single men and women, according to the Pew Research Center. With a national average of 52% (men) and 48% (women) married, the District sports a mere 28% (men) and 23% (women) married. The next lowest numbers are 47% (men) for Alaska and 43% (women) for Rhode Island. (These numbers are for the 15 and older crowd.)

One commentator believes this is due to the unique demographics of DC: very high black population (less likely to marry) and very high Democratic population (more likely to marry later). Another points to the 8.2% gay population as the culprit (along with the marry later point). These are certainly factors, but there's a much more obvious reason that I think carries the bulk of the explanation.

Married people tend to want to start families which generally means a bigger home and unless there's also a big raise, that means moving to the suburbs. In most states, moving to the suburbs can but not always means changing your state. But in DC, it always means leaving DC and heading to Maryland or Virgina (or West Virgina). So the states include both the city proper and the suburbs but DC includes only the city proper. Big difference.

One commentator believes this is due to the unique demographics of DC: very high black population (less likely to marry) and very high Democratic population (more likely to marry later). Another points to the 8.2% gay population as the culprit (along with the marry later point). These are certainly factors, but there's a much more obvious reason that I think carries the bulk of the explanation.

Married people tend to want to start families which generally means a bigger home and unless there's also a big raise, that means moving to the suburbs. In most states, moving to the suburbs can but not always means changing your state. But in DC, it always means leaving DC and heading to Maryland or Virgina (or West Virgina). So the states include both the city proper and the suburbs but DC includes only the city proper. Big difference.

Labels:

Culture

Friday, October 09, 2009

The Economics of the Movie Ticket

A couple of days ago, Nicholas Tabarrok noted the strange economics of the film industry at MR. Movie theaters do not charge lower prices for movies that are unpopular. Similarly, highly anticipated movies have the same ticket price as movies that are proven flops. Why is that?

If the movie theater charged different prices for movies, it would need to hire individual ticket takers for multiple theater entrances at the multiplex--one for each theater that's seating at the time (otherwise people would just buy the cheapest ticket). This is a drastic increase in costs both in payment to the employees and to management, who must now organize a complex system of employees.

Instead, the theater simply adjusts how long a movie is being shown. Good movies are shown for a while, bad movies leave the theater quickly (making room for theaters showing the good movie). It's not as direct as individual pricing, but it's much more cost effective.

If the movie theater charged different prices for movies, it would need to hire individual ticket takers for multiple theater entrances at the multiplex--one for each theater that's seating at the time (otherwise people would just buy the cheapest ticket). This is a drastic increase in costs both in payment to the employees and to management, who must now organize a complex system of employees.

Instead, the theater simply adjusts how long a movie is being shown. Good movies are shown for a while, bad movies leave the theater quickly (making room for theaters showing the good movie). It's not as direct as individual pricing, but it's much more cost effective.

Labels:

Markets

Wednesday, October 07, 2009

Information on the Margin

According to a study, New York City's new laws requiring calorie counts on fast food restaurants doesn't appearing to be having any net effect on food purchases. One would think this law would get people to steer clear of fast food, but it's easy to see why, in practice, this doesn't make any bit of difference.

Like smoking, the unhealthiness of fast food is common knowledge. Telling them exactly how many calories are in X, Y, and Z change anything because they're not seen as relevant (ignoring that a high calorie count isn't the same thing as being unhealthy). If you already know a Big Mac is bad for you, knowing it has 576, not 500, calories isn't going to change your decision.

It's too costly to calculate everything down to such fine nuance. Instead, people think in broad categories. Now, if estimated calorie count was off by a factor of 2 or 10, we'd see some real movement. But, on the margin, this information adds virtually nothing. People are good at estimating calories by themselves.

Like smoking, the unhealthiness of fast food is common knowledge. Telling them exactly how many calories are in X, Y, and Z change anything because they're not seen as relevant (ignoring that a high calorie count isn't the same thing as being unhealthy). If you already know a Big Mac is bad for you, knowing it has 576, not 500, calories isn't going to change your decision.

It's too costly to calculate everything down to such fine nuance. Instead, people think in broad categories. Now, if estimated calorie count was off by a factor of 2 or 10, we'd see some real movement. But, on the margin, this information adds virtually nothing. People are good at estimating calories by themselves.

Labels:

Rationality

Saturday, September 26, 2009

Not All Yale Students Are Hippies

Tanya and I are at some coffee shop in New Haven and I noticed on patron has a quote attributed to John Maynard Keynes on her laptop:

Capitalism is the extraordinary belief that the nastiest of men, for the nastiest of reasons, will somehow work for the benefit of all.Apparently, this quote isn't from Keynes, but it's a good sentence nonetheless and reminds me of this quote from F.A. Hayek's The Fatal Conceit:

The curious task of economics is to demonstrate to men how little they really know about what they imagine they can design.(It occurs to me this person might think the quote is sarcastic but I hope not. That would ruin my title.)

Labels:

Emergent Order

Friday, September 18, 2009

Incentives to Inquire

Students don't like asking questions. For a while, I thought it was simply because they are shy and need to be enticed out of their shell (I still believe this, but less so now) so I require participation for the grade. An undergraduate friend of mine told me of another reason:

It's tempting to solve this issue by just over-booking each lecture, but it makes you look disorganized. It also creates the risk of having material constantly spilling over to the next lecture until you get backed up at the end of the semester and your homework and exam assignments get out of whack.

So my solution I will be trying out in the future is to create one or two five-minute "widgets" at the end of each lecture. Short extensions on the topic we covered, but small enough that if we don't cover them I don't feel a big loss. When the semester begins, I let them know the rules: if we finish before we get the widgets, then I assume they have mastered the nuances of this lecture and we can further their understanding with applications (which will be now be on the exam). If we don't get to them, they won't be tested over them. Therefore, students are incentivized to ask questions, filling in the time by furthering their understanding of the material in order to avoid a larger exam. Since I have the power to veto questions, I can't imagine I'll be bogged down with filler inquiries in an attempt to game the system. I hope there aren't any unintended consequences I haven't thought of.

We know the professor only has so much material planned for a lecture. If we get it all done before time is up, they have to let us out early. But whenever anyone asks a question or asks to elaborate, that pushes the time we get to leave, back.This is a problem. Most students don't understand the first time around or will forget if they don't talk about the subject matter. And there's a lost life lesson in the importance of speaking up. The reality is doubly a problem for my style since I make the lecture notes available online before each class.

It's tempting to solve this issue by just over-booking each lecture, but it makes you look disorganized. It also creates the risk of having material constantly spilling over to the next lecture until you get backed up at the end of the semester and your homework and exam assignments get out of whack.

So my solution I will be trying out in the future is to create one or two five-minute "widgets" at the end of each lecture. Short extensions on the topic we covered, but small enough that if we don't cover them I don't feel a big loss. When the semester begins, I let them know the rules: if we finish before we get the widgets, then I assume they have mastered the nuances of this lecture and we can further their understanding with applications (which will be now be on the exam). If we don't get to them, they won't be tested over them. Therefore, students are incentivized to ask questions, filling in the time by furthering their understanding of the material in order to avoid a larger exam. Since I have the power to veto questions, I can't imagine I'll be bogged down with filler inquiries in an attempt to game the system. I hope there aren't any unintended consequences I haven't thought of.

Labels:

Teaching

Tuesday, September 08, 2009

On Racism and Income In America

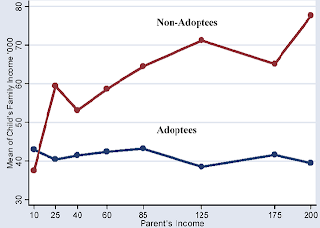

During a heated discussion with my girlfriend the other day, I brought up the graph below from a post I saw on Marginal Revolution. It's summary data from an adoption study when primarily Korean children were adopted by American families of various incomes between 1970 and 1980. Now in their 20s and 30s, the graph summarizes their parents income (presumably at the time of adoption, hopefully adjusted for inflation) along the x-axis and the child's average income along the y-axis.

This, I said, is a very interesting study: adopted kids did about the same (on average) regardless of who brought them up. But when they are the natural kids of the parents, they do better on average. Since it's reasonable to say other effects are constant across incomes (such as how parents treat an adopted child), the data suggests that genetics play a critical role in determining income and that the wealthy are not wealthy simply because their parents were. (Note there is still a high level of income mobility in the data: 10K a year parents averaged almost 40K a year kids; 200K a year parents averaged only about 78K a year kids...though the latter point could be argued by wealthier kids opting for jobs with fewer financial awards and more non-pecuniary benefits.)

Tanya didn't agree on a few levels, for one arguing that it suggests low black incomes are low because blacks are stupid. But the study doesn't say that environmental factors don't influence future prospects (though I am admittedly surprised to see how uncorrelated adopted incomes were with their parents) nor was it a perfect study. Since adoption agencies are ethically bound to make sure the couple could provide for the child before adoption, the selection bias would overestimate the success at the lower levels of income.

Tanya was also concerned about effects embedded in the adoption. Since the kids were Korean, they were clearly adopted. Thus, she argues, issues of racism and the stigma of being adopted washed out and overshadowed any advantage wealthier kids had. Sure, this exists, but I'm not convinced these factors are so strong it would wash away all environmental advantages. Yes, the children grew up in the 70s and 80s, where racial tension was likely stronger compared to now, but such tension tends to lean toward the Afro-American and (to a lesser degree) Hispanic populations, not Southeast Asians.

Really, I have don't know how much racism is in America. Most people don't know. Of course, it still exists and minorities will have first hand experience with it. But that doesn't mean it's common. Similarly, most white people I know (myself included), are good people and most scared of a misunderstanding being mistaken for racism. That does not mean most white are not racists. And surveys done on the issue are going to have major credibility issues about the honesty of people's responses. I can say with confidence that black incomes are rising, interracial couples are more common, and companies are very concerned with being thought of as inclusive; at least things seem to be getting better.

This, I said, is a very interesting study: adopted kids did about the same (on average) regardless of who brought them up. But when they are the natural kids of the parents, they do better on average. Since it's reasonable to say other effects are constant across incomes (such as how parents treat an adopted child), the data suggests that genetics play a critical role in determining income and that the wealthy are not wealthy simply because their parents were. (Note there is still a high level of income mobility in the data: 10K a year parents averaged almost 40K a year kids; 200K a year parents averaged only about 78K a year kids...though the latter point could be argued by wealthier kids opting for jobs with fewer financial awards and more non-pecuniary benefits.)

Tanya didn't agree on a few levels, for one arguing that it suggests low black incomes are low because blacks are stupid. But the study doesn't say that environmental factors don't influence future prospects (though I am admittedly surprised to see how uncorrelated adopted incomes were with their parents) nor was it a perfect study. Since adoption agencies are ethically bound to make sure the couple could provide for the child before adoption, the selection bias would overestimate the success at the lower levels of income.

Tanya was also concerned about effects embedded in the adoption. Since the kids were Korean, they were clearly adopted. Thus, she argues, issues of racism and the stigma of being adopted washed out and overshadowed any advantage wealthier kids had. Sure, this exists, but I'm not convinced these factors are so strong it would wash away all environmental advantages. Yes, the children grew up in the 70s and 80s, where racial tension was likely stronger compared to now, but such tension tends to lean toward the Afro-American and (to a lesser degree) Hispanic populations, not Southeast Asians.

Really, I have don't know how much racism is in America. Most people don't know. Of course, it still exists and minorities will have first hand experience with it. But that doesn't mean it's common. Similarly, most white people I know (myself included), are good people and most scared of a misunderstanding being mistaken for racism. That does not mean most white are not racists. And surveys done on the issue are going to have major credibility issues about the honesty of people's responses. I can say with confidence that black incomes are rising, interracial couples are more common, and companies are very concerned with being thought of as inclusive; at least things seem to be getting better.

Labels:

Wages

Wednesday, September 02, 2009

The Burden of the Pre-existing Condition

If you were born with Asperger syndrome, should people be forced to date you? Most of you would probably say "no." It's a good answer: why should people be punished for something that isn't their fault? So why do so many believe health insurance companies should be required to accept applicants with pre-existing conditions? (Before you respond with "I don't want to date someone who doesn't want to date me," remember Asperger syndrome severely limits your ability to read social cues; you won't be able to tell they are with you only by force.)

It's not even that insurance companies won't cover pre-existing conditions. It's that they won't cover them at a particular price: a low price. In the end there are those randomly burdened with a condition that's expensive to care for and they don't want to pay for it (at least all of it). But that does not translate into forcing someone else to cover the costs.

And no, insurance companies are not sitting on lots of excess cash. Record profits are not the same thing as high profits (and even if they were, proposing a permanent change based on temporary conditions is very reckless way to make policy). Because they are barely profitable, forcing their costs up with such reforms will force prices up and making it too expensive for someone who could otherwise get it. Now we are forcing our neighbor to carry the burden of our condition. Where's the justice in that?

It's not even that insurance companies won't cover pre-existing conditions. It's that they won't cover them at a particular price: a low price. In the end there are those randomly burdened with a condition that's expensive to care for and they don't want to pay for it (at least all of it). But that does not translate into forcing someone else to cover the costs.

And no, insurance companies are not sitting on lots of excess cash. Record profits are not the same thing as high profits (and even if they were, proposing a permanent change based on temporary conditions is very reckless way to make policy). Because they are barely profitable, forcing their costs up with such reforms will force prices up and making it too expensive for someone who could otherwise get it. Now we are forcing our neighbor to carry the burden of our condition. Where's the justice in that?

Tuesday, August 18, 2009

The Value of Life

Ask most people how much they value their life and they will inevitably say "an infinite amount." That's what my girlfriend told me the other day (generated from a conversation I've forgotten the origins of). "This cannot possibly be true," I said. "You take risks."

Mathematically, here's how it works. The expected cost of any activity under uncertainty is the likelihood of the event times the cost if the event occurred. A fifty percent chance of losing $200 means that the expected cost is $100. For any activity there is a probability you will die, or lose that life you value at an infinite amount. Thus, it's an infinite cost no matter what you multiply it by, no matter how risky the activity is. Since you have to do something to stay alive, you should always choose the least risky activity, no matter how much you might value the alternative because of the costs of that activity are infinite.

That people value their life only because they value what they can do with it doesn't change the math. In life, there are always options. You can watch TV or skydive: both are valuable to you and while the former might be more fun after 8 hours of TV a day, it is still too costly. But people still skydive.

They also show their finite value of their own life in other ways. People speed, jaywalk, ignore check engine lights, confront rude people (who might kill them out of anger), forget to check smoke detectors, travel to foreign countries, and eat unhealthy food. When we change our estimations of how dangerous (or safe) an activity is, we change our behavior. But if we valued our life infinitely, that shouldn't change anything (as the costs would come out the same regardless of the probability of death). Clearly, the costs to risking your life are lower than you might think.

Mathematically, here's how it works. The expected cost of any activity under uncertainty is the likelihood of the event times the cost if the event occurred. A fifty percent chance of losing $200 means that the expected cost is $100. For any activity there is a probability you will die, or lose that life you value at an infinite amount. Thus, it's an infinite cost no matter what you multiply it by, no matter how risky the activity is. Since you have to do something to stay alive, you should always choose the least risky activity, no matter how much you might value the alternative because of the costs of that activity are infinite.

That people value their life only because they value what they can do with it doesn't change the math. In life, there are always options. You can watch TV or skydive: both are valuable to you and while the former might be more fun after 8 hours of TV a day, it is still too costly. But people still skydive.

They also show their finite value of their own life in other ways. People speed, jaywalk, ignore check engine lights, confront rude people (who might kill them out of anger), forget to check smoke detectors, travel to foreign countries, and eat unhealthy food. When we change our estimations of how dangerous (or safe) an activity is, we change our behavior. But if we valued our life infinitely, that shouldn't change anything (as the costs would come out the same regardless of the probability of death). Clearly, the costs to risking your life are lower than you might think.

Labels:

Costs and Benefits

Wednesday, August 12, 2009

Milk, Cheese, and the Myth of Retail Collusion

This week's Economist told the story of falling wholesale milk prices which are bringing EU farmers to call for lower milk production quotas. Some farmers blame supermarkets for the lower prices, noting that they sell milk at about the same price but buy it from farmers at a significantly reduced price.

Falling consumer demand (especially given the recession) isn't the explanation EU farmers give, and it certainly doesn't seem to explain the inconsistency at the supermarket. But the Economist linked them, though they didn't say how. The short version is: it's all about the cheese.

Cheese demand has fallen a lot, especially within the EU. Unlike milk, people buy a lot less cheese when their incomes fall. But cheese is made from milk and in the wholesale market, all cheese is milk (since cheese-makers are buying it to turn into cheese). In other words, grocers who want milk for milk compete with cheese-makers who want milk for cheese. But people want less cheese so there's less demand for wholesale milk.

Just as more cheese-makers bid up the price of milk (and a growing China bids up the price for gas down the street), fewer cheese-makers means there's downward pressure on prices. Grocers, then, are getting their milk on the cheap. But the market for milk-at-the-store changed very little. So we see grocers getting cheap milk, selling it at about the same price, and it's all thanks to consumer demand, not colluding grocers.

Falling consumer demand (especially given the recession) isn't the explanation EU farmers give, and it certainly doesn't seem to explain the inconsistency at the supermarket. But the Economist linked them, though they didn't say how. The short version is: it's all about the cheese.

Cheese demand has fallen a lot, especially within the EU. Unlike milk, people buy a lot less cheese when their incomes fall. But cheese is made from milk and in the wholesale market, all cheese is milk (since cheese-makers are buying it to turn into cheese). In other words, grocers who want milk for milk compete with cheese-makers who want milk for cheese. But people want less cheese so there's less demand for wholesale milk.

Just as more cheese-makers bid up the price of milk (and a growing China bids up the price for gas down the street), fewer cheese-makers means there's downward pressure on prices. Grocers, then, are getting their milk on the cheap. But the market for milk-at-the-store changed very little. So we see grocers getting cheap milk, selling it at about the same price, and it's all thanks to consumer demand, not colluding grocers.

Labels:

Prices and Profit

Sunday, August 02, 2009

Collusion and Commons

I hope my micro students can answer the following:

How is collusion between firms like a tragedy of the commons? In answering this question, make sure to define tragedy of the commons, reference positive and negative externalities, and summarize the incentives of individual firms.

Labels:

Teaching

Thursday, July 30, 2009

On the Economics of Sidewalks

Today on the Kojo Nnamdi Show, DC residents debated the pros and cons of adding sidewalks to northwest neighborhoods that still lack them. Well, it was mostly pros, from making walking easier to complying with Americans With Disabilities act. The cons were concerned with losing what country-feel they had in the metro area and that few people actually use sidewalks that are installed.

But no one mentioned another problem with adding sidewalks, not surprising because the pros are unlikely aware of it and the cons wouldn't want to admit it: adding sidewalks increase foot traffic and make life harder on those that live there. In economic jargon, sidewalk traffic externalizes costs on surrounding residents.

Sidewalks make walking cheaper and so, no doubt, you'll get more foot traffic. That means more dog walkers, and the increased risk of the dog walker not cleaning up after her animal when he does his business. That means more children running around, and the higher likelihood of noise and damage from particularly active kids. It means more people lingering in a driveway, trampling lawns or flowers, and risk seeing you while being intimate with loved ones (sometimes you forget to close the drapes).

It sounds so selfish, but why should local residents bear the cost of other's enjoyment? The common theme when people called in is that they moved to those areas because the lack of sidewalks made it feel more rural. They were looking for one thing: isolation.

Note: For the record, I'm in favor of the sidewalks only because, in my estimation, the costs externalized onto residents with the sidewalks are likely lower than the costs which must be suffered by people because there are no sidewalks to use.

But no one mentioned another problem with adding sidewalks, not surprising because the pros are unlikely aware of it and the cons wouldn't want to admit it: adding sidewalks increase foot traffic and make life harder on those that live there. In economic jargon, sidewalk traffic externalizes costs on surrounding residents.

Sidewalks make walking cheaper and so, no doubt, you'll get more foot traffic. That means more dog walkers, and the increased risk of the dog walker not cleaning up after her animal when he does his business. That means more children running around, and the higher likelihood of noise and damage from particularly active kids. It means more people lingering in a driveway, trampling lawns or flowers, and risk seeing you while being intimate with loved ones (sometimes you forget to close the drapes).

It sounds so selfish, but why should local residents bear the cost of other's enjoyment? The common theme when people called in is that they moved to those areas because the lack of sidewalks made it feel more rural. They were looking for one thing: isolation.

Note: For the record, I'm in favor of the sidewalks only because, in my estimation, the costs externalized onto residents with the sidewalks are likely lower than the costs which must be suffered by people because there are no sidewalks to use.

Labels:

Environment

Saturday, July 25, 2009

The Good, the Bad, and Healthcare

Critics of government backed health care seem schizophrenic: on one hand, they argue government run health care will be really awful. On the other hand, they argue it will crowd out private health care if the two compete. How can it be so bad no one will want it but so good everyone will abandon all other options?

The two seem to be mutually exclusive and on some level they are. For example, the post office competes with FedEx all the time for package delivers. Sometimes people use one, sometimes the other. No doubt that the existence of competition improved the government system, though how much better is not obvious.

There is an area, though, where the government system is quite low quality but people still attend it: public schools. Ignore your personal experiences for the moment. People complain a lot more about public schools than they do about private ones. And while I seem to remember some data that, like FedEx, private schools improve their government counterpart, again the degree is difficult to pin down.

How is this possible? How are public schools so popular but so bad? There's lots of possible reasons but one reason sticks out: it's really cheap. In fact, baring fees and supplies, it's free. Those costs are then burdened onto everyone else and the public subsidizes a low quality service. There is some value to public schools, of course, which is why people still send their kids there. Everyone else, including private schools, indirectly pays for a product they either don't value that much or compete with. So is the nature of taxes.

Health care risks walking down the same path. In fact, it already has. Medicare and Medicaid, by law, buy hospital services at about 20% less than the cost to the hospital. It is one of the reasons why everyday objects, like Tylenol, run several dollars a pill. Hospitals have to make up the difference somewhere. Adopting this policy for everyone follows depressingly close to Bastiat's take on government: "Government is the great fiction through which everybody endeavors to live at the expense of everybody else." A great fiction indeed.

The two seem to be mutually exclusive and on some level they are. For example, the post office competes with FedEx all the time for package delivers. Sometimes people use one, sometimes the other. No doubt that the existence of competition improved the government system, though how much better is not obvious.

There is an area, though, where the government system is quite low quality but people still attend it: public schools. Ignore your personal experiences for the moment. People complain a lot more about public schools than they do about private ones. And while I seem to remember some data that, like FedEx, private schools improve their government counterpart, again the degree is difficult to pin down.

How is this possible? How are public schools so popular but so bad? There's lots of possible reasons but one reason sticks out: it's really cheap. In fact, baring fees and supplies, it's free. Those costs are then burdened onto everyone else and the public subsidizes a low quality service. There is some value to public schools, of course, which is why people still send their kids there. Everyone else, including private schools, indirectly pays for a product they either don't value that much or compete with. So is the nature of taxes.

Health care risks walking down the same path. In fact, it already has. Medicare and Medicaid, by law, buy hospital services at about 20% less than the cost to the hospital. It is one of the reasons why everyday objects, like Tylenol, run several dollars a pill. Hospitals have to make up the difference somewhere. Adopting this policy for everyone follows depressingly close to Bastiat's take on government: "Government is the great fiction through which everybody endeavors to live at the expense of everybody else." A great fiction indeed.

Labels:

Regulation,

Unintended Consequences

Thursday, July 16, 2009

Fundamental Mistakes

Never before have I seen so many basic errors in such a short amount of time when Douglas Rushkoff went on the Colbert Report to promote his book, Life, Inc. The errors are too numerous to address each one, but two stand out as particularly sloppy.

First he claims that pursuing supposedly noneconomic avenues, such as having friends or taking walks, are drains on the GNP. "[Corporations] crowd out every kind of activity." Instead, people are forced to "support the economy with consumption we don't want or need." Most firm would love it if that were true. If they could control people's lives, they wouldn't have to work so hard to stay competitive. But trade, as my students recently learned, is mutually beneficial. What world does Rushkoff live in where people are forced to buy things they don't want?

In an attempt to criticize measuring wealth through spending, he argued that "if everyone got cancer tonight, that's good for the economy" because people would spend more money. But no one actually familiar with how economists measure wealth would make such a juvenile confusion. GDP and GNP are proxies, convenient estimations because capturing everything is impractical or impossible. We are fully aware that there is more to wealth than what we can count and changes like the one Rushkoff sarcastically propose are nothing more than playing voodoo with the numbers.

First he claims that pursuing supposedly noneconomic avenues, such as having friends or taking walks, are drains on the GNP. "[Corporations] crowd out every kind of activity." Instead, people are forced to "support the economy with consumption we don't want or need." Most firm would love it if that were true. If they could control people's lives, they wouldn't have to work so hard to stay competitive. But trade, as my students recently learned, is mutually beneficial. What world does Rushkoff live in where people are forced to buy things they don't want?

In an attempt to criticize measuring wealth through spending, he argued that "if everyone got cancer tonight, that's good for the economy" because people would spend more money. But no one actually familiar with how economists measure wealth would make such a juvenile confusion. GDP and GNP are proxies, convenient estimations because capturing everything is impractical or impossible. We are fully aware that there is more to wealth than what we can count and changes like the one Rushkoff sarcastically propose are nothing more than playing voodoo with the numbers.

Labels:

Economy

Thursday, July 09, 2009

In Praise of Passive Investment

As regulators ponder making it harder for speculators to invest in oil, University of Maryland law professor Michael Greenberg backed such acts against "passive" investing on WTOP radio yesterday. He correctly identifies them as having "no interest in actively controlling these assets, just hoping to make a buck when their prices rise."

I wonder when Greenberg will take arms against other forms of passive investing:

-The university which offers financial aid to smarter or more driven students, betting that their attendance will yield more donations long after they graduate.

-The company which helps pay for its employee's education, hoping the employee will remain with the company even after a minimum staying period.

-The firm which gives its employees on-the-job-training, familiarizing them with a system they could apple elsewhere.

-The patron of the arts who supports a starving artist in the hopes they will be a success later.

In each case, the person hasn't actually become valuable yet, just like the oil that investors jump on (or off of). Speculators (who bet the price will rise) will buy oil now and cash out when it's more valuable. Passive investors in human capital do the same thing.

I wonder when Greenberg will take arms against other forms of passive investing:

-The university which offers financial aid to smarter or more driven students, betting that their attendance will yield more donations long after they graduate.

-The company which helps pay for its employee's education, hoping the employee will remain with the company even after a minimum staying period.

-The firm which gives its employees on-the-job-training, familiarizing them with a system they could apple elsewhere.

-The patron of the arts who supports a starving artist in the hopes they will be a success later.

In each case, the person hasn't actually become valuable yet, just like the oil that investors jump on (or off of). Speculators (who bet the price will rise) will buy oil now and cash out when it's more valuable. Passive investors in human capital do the same thing.

Labels:

Economy

Wednesday, July 08, 2009

Voting Three Times A Day

Robert Kenner's new movie, Food, Inc., argues that food is too cheap and, thanks to health-related issues from diabetes, will end up being more expensive in the long run. While Kenner is lacking in his rationality (it's hard to make the argument that it's bad to give people more options in the form of cheaper food) he recognizes that consumers are the key to the problem. When he appeared on The Daily Show last week, he reminded Jon Stewart that the consumer "votes three times a day." If consumers want healthier food, they will demand it and producers will provide. They will have to if they want to stay in business. But most Americans aren't demanding these things, even those who know all the messy origins. At the end of the day, people vote for fat and that's their choice.

Labels:

Rationality

Monday, June 29, 2009

iPods Are Not Cylons

While cleverly defending copyright law, identifying those against it as having a "bias to the collective," Mark Helprin on this week's EconTalk falls victim to his own collectivist leanings. He argues that many people succumb to "perverse adaptation." People adapt to technology instead of technology adapting to them. Helprin invokes images of commuters staring at their blackberries and consumers demanding things faster and faster as examples.

Human beings require time for reflection...We require stillness and the ability to absorb things rather than just being hooked up to a machine and made into bundles of tropisms. [Emphasis added]But those who don't are not dead. We do not require these things. We may require them to accomplish certain goals, goals Helprin places high value on, but we do not require them in the absolute sense. We choose to not do them. Technology does not leap in our lap and hook into us like a drone from the Matrix. Those people who Helprin paints as so grey are people who always wanted to move faster; technology simply allows them to do it. It's not that technology has enslaved us. Helprin simply believes that if people don't like the same things he does, there's something wrong with them. Such an attitude is the hallmark of the collective mindset.

Labels:

Culture

Pay Grades in the Extralegal Sector

In Peter Leeson's new book, The Invisible Hook, Leeson notes the pay grade was quite flat (pirate captains were paid twice as much as the lowest member of the crew, compared to merchant captains of that same era which were paid five or six times as much). He argues it's to encourage solidarity, discouraging envy and encouraging unanimous approval to continue on their plundering ways (a skewed system would encourage those at the top to stop and those at the bottom to keep going, thus creating tension).

But the same could be said of drug dealers, who have a very skewed pay scale. As Steven Levitt and Stephen Dubner note, the top drug dealers earns about 100 times that of the lowest earner. But gangs of this sort don't show the lack of harmony or disloyalty that should be plagued by Leeson's explanation. So how do we reconcile these two different worlds?

The key difference between a pirate ship and a drug-dealing gang is the level of entanglement with their surroundings. A pirate ship is basically a floating island and because it's so isolated, it's relatively easy for anyone to see how the game is played. A gang, on the other hand, is entangled with the larger surroundings. There's a lot of activity members don't see and many critical relations with those outside the gang that most don't have. In other words, the lowly sailor is a closer substitute to his captain than a lowly drug dealer is to his top boss. While a rebellious sailor might be able to handle captaining competently, a rebellious drug dealer would likely not have the same level of success. This also explains why pirates elected their captain while dealers autocratically promote from below (thus why the higher ups are paid so much: to encourage lower ranks to work harder on the chance they can be promoted).

But the same could be said of drug dealers, who have a very skewed pay scale. As Steven Levitt and Stephen Dubner note, the top drug dealers earns about 100 times that of the lowest earner. But gangs of this sort don't show the lack of harmony or disloyalty that should be plagued by Leeson's explanation. So how do we reconcile these two different worlds?

The key difference between a pirate ship and a drug-dealing gang is the level of entanglement with their surroundings. A pirate ship is basically a floating island and because it's so isolated, it's relatively easy for anyone to see how the game is played. A gang, on the other hand, is entangled with the larger surroundings. There's a lot of activity members don't see and many critical relations with those outside the gang that most don't have. In other words, the lowly sailor is a closer substitute to his captain than a lowly drug dealer is to his top boss. While a rebellious sailor might be able to handle captaining competently, a rebellious drug dealer would likely not have the same level of success. This also explains why pirates elected their captain while dealers autocratically promote from below (thus why the higher ups are paid so much: to encourage lower ranks to work harder on the chance they can be promoted).

Tuesday, June 23, 2009

Franchise Laws of the Automaker Apocalypse

Imagine for a moment that television studios by law had to continue making shows they would normally cancel. Or fast food chains had to make menu items that few people buy. Imagine we still lived in a world of New Coke, Arch Deluxe, and Cavemen. Well wake up because when it comes to cars, that's the world we live in.

As Mike Munger and Russ Roberts discuss in the latest EconTalk, car franchises long ago lobbied local governments to pass laws handing dealers a string of advantages over the corporate office. In the vast majority of states, two dealers can't sell the same model within fifty miles of each other (stories that the franchises are too densely packed aren't true), corporate must make a strong effort to advertise each brand, only dealers can unilaterally terminate the dealership agreement (unless the dealer does a very poor job selling), and corporate must keep supplying the dealership with a minimum number of cars. Dealerships did this because each franchise is based around one model of car. But it also means that any model GM, Chrysler, or Ford make is a model they can never get rid of (though they can re-imagine it).

There's lots of problems the American automobile industry has (and the podcast goes into more detail) but I found these laws most shocking. They also explain a lot (such as why foreign makers focus on a few good brands). Paradoxically, it was the domestic dealers that brought down the Big Three; the only way out of these dead-end dealerships is bankruptcy.

As Mike Munger and Russ Roberts discuss in the latest EconTalk, car franchises long ago lobbied local governments to pass laws handing dealers a string of advantages over the corporate office. In the vast majority of states, two dealers can't sell the same model within fifty miles of each other (stories that the franchises are too densely packed aren't true), corporate must make a strong effort to advertise each brand, only dealers can unilaterally terminate the dealership agreement (unless the dealer does a very poor job selling), and corporate must keep supplying the dealership with a minimum number of cars. Dealerships did this because each franchise is based around one model of car. But it also means that any model GM, Chrysler, or Ford make is a model they can never get rid of (though they can re-imagine it).

There's lots of problems the American automobile industry has (and the podcast goes into more detail) but I found these laws most shocking. They also explain a lot (such as why foreign makers focus on a few good brands). Paradoxically, it was the domestic dealers that brought down the Big Three; the only way out of these dead-end dealerships is bankruptcy.

Labels:

Regulation

Saturday, June 20, 2009

How Obama Got People to Be Less Afraid of Being Republican

Robin Hanson proposes that Obama's election makes the public more conservative. No, the story isn't that Americans are secretly racist and have suddenly come to terms with their racism. Quote psychology experiments,

People care what others think of them, even if those others are strangers. We care about it so much, we say we believe things we don't believe. If we value the truth on an issue low enough, ewe even fool ourselves into believing things we'd normally conclude are false. (Bryan Caplan calls this rationally irrationality.) In essence, we are paid (in the form of social capital) to conform.

The reason why we care so much about we others think of us is that we care what others think. We like to associate with people who are like us, a trend easily seen in grade school, high school, college, and beyond. This isn't merely shared interest but political opinion and values; constantly arguing with someone about politics gets exhausting for most people. It also makes it easier to talk to people since there's more common ground and you don't have to police your offhand comments or jokes.

There are lots of issues, though, and it's inefficient to list off your opinion on all of them. This is why we use labels (to the annoyance of some), such as Democratic, Republican, Libertarian, Populist, Christian, Muslim, Atheist, Jew, Protectionist, Free-trader, etc. In a single word, we convey a body of opinions to potential friends or mates. This is why it is normal for dating sites to post a person's political affiliation: it's a cheap way to convey important information.

But it's not perfect. Some issues are more important to some people than others and individuals are more diverse than the label's official or perceived hierarchy of priorities. We want to connect with people that share what we care about, starting with top priorities. People will then adopt most of the views of one group, including views they don't believe, to signal that they believe things that they find very important and distinguish themselves from the group that seems (rightly or wrongly) to disagree with them, even if they secretly agree with that group on less important issues. When an event convinces people that most agree with what you find to be really important, you will more accurately express your view of the less important things since you are less afraid of being mistaken for some other group.

To illustrate, consider two parties: D (Democratic) and R (Republican). Also consider two issues: A (being for racial equality) and B (being for less gun control). ~A means, then, that a group is perceived as being against racial equality and ~B means that a group is perceived as being against less gun control (or in favor for more gun control). Before Obama, one could argue that the public views the parties as so:

D (A, ~B)

R (~A, B)

Consider a person who has the preference of (A, B), but cares much more about A than B. In other words, he'd rather spend time with a person who's restricting gun ownership and is racially tolerate than a racist gun nut. U(A, ~B) > U(~A, B) (U stands for utility, economic lingo for satisfaction.) Thus, he will adopt policies of both racial tolerance and gun control to better signal that he's a Democrat, making it more likely he'll spend time with his preferred type of person. He might even start believing B, since he'll have to argue the point at parties and it's easier to argue something if you fool yourself into believing it's true. (This is where the rational irrationality comes in.)

But suddenly, Obama is elected president and it starts to look less like ~B is a staple of group R. If so many Americans were racist, it's hard to believe a black man could win (especially since he got 52.9%). Thus, the public perceives racism as being uncommon enough that it isn't a defining attribute of a major political party. At worst, the public's opinion on the stance is uncertain and the perception changes to this:

D (A, ~B)

R (?, B)

Now back to our hypothetical (A, B). No longer concerned with openly believing B will attract ~A people, he expresses his B opinion (or overturns his previous ~B opinion). He is no longer afraid of being mistaken for R.

In practice, there are more than two issues and people might still call themselves Democrats out of habit, fear of losing current friends, or because there's still enough about the party they like. But, in time, more will be willing to. In the meantime, expressing the secondary opinion will be more common. So, here's the punchline: Obama's election made Americans, and by extension moderate Republicans, seem less racist. Thus more people are willing to be seem as (or mistaken for) a Republican.

People were more willing to express potentially prejudiced attitudes when their past behavior had given them a bit of credentials as a nonpredjudiced person.Bizarrely, Hanson cites recent polls that Americans are more in favor of gun control, less in favor of legalized abortion, and fewer people believing global warming is the result of human activity as evidence of this theory. What does racial issues such as affirmative action have to do with climatology?

People care what others think of them, even if those others are strangers. We care about it so much, we say we believe things we don't believe. If we value the truth on an issue low enough, ewe even fool ourselves into believing things we'd normally conclude are false. (Bryan Caplan calls this rationally irrationality.) In essence, we are paid (in the form of social capital) to conform.

The reason why we care so much about we others think of us is that we care what others think. We like to associate with people who are like us, a trend easily seen in grade school, high school, college, and beyond. This isn't merely shared interest but political opinion and values; constantly arguing with someone about politics gets exhausting for most people. It also makes it easier to talk to people since there's more common ground and you don't have to police your offhand comments or jokes.